Introduction Anti money laundering (AML) compliance in the UK is overseen by appointed supervisory authorities. AML for Annex 1 registered firms has recently come under scrutiny by the FCA after their assessment into money laundering prevention processes. The regulator found cases of discrepancies between the registered and actual activities carried out by firms. In addition, […]

Market Leading AML Policies & Controls Are you looking for templates for anti money laundering (AML)? If so, look no further! Know Your Compliance Limited is one of the UK’s top providers of customisable AML templates and policies. With nearly 10,000 firms already using our regulatory policy documents, you’ll be in good company. AML compliance […]

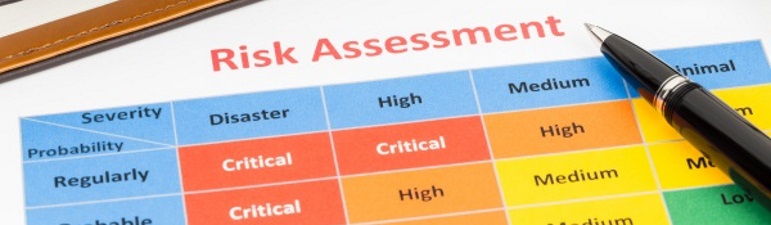

This article written by Know Your Compliance Limited gives an overview of a fraud risk assessment example and provides guidance on the fraud risk assessment process. If you are looking for customisable fraud prevention policies, jump straight to our Anti Fraud Template Toolkit. What is Fraud? Fraud is any intentional deception that results in financial […]

What is Due Diligence? Why do you need to perform due diligence client risk assessments? Customer due diligence is the assessment, investigation and review of a supplier, business or individual with whom a company intends to form a business relationship. However, in addition to standard due diligence, part of the customer due diligence process is […]

How do you know if you are complying with your Money Laundering Regulations (MLR) obligations? Why Use an AML Compliance Checklist? The rules in the MLR are extensive and when added to those of AML Supervisory Authorities, such as the HMRC and FCA, the scope is even broader. You want to be sure you are […]

Anti Money Laundering templates for small firms should provide ready-to-use content that is easily customised. Many of the smaller firms who have obligations under the Money Laundering Regulations are supervised by the HMRC. However, some have other supervisory authorities such as the FCA or professional bodies. Whoever your AML supervisor is, you will need to […]

What is Third Party Reliance? Using third party reliance templates enables you to meet your AML and due diligence obligations whilst complying with the mandatory regulations. Third party reliance does exactly what it says, it enables a relevant person to rely on a third party for carrying out certain due diligence measures. Part 4. Section […]

Anti-fraud policies and procedures make up an essential part of any business’s compliance program. Firm’s have a duty of care to assess the risk of fraud posed to their business and to put processes into place to mitigate these. This article provide information and suggestions for writing an anti fraud policy and the associated fraud […]

All businesses with obligations under the Money Laundering Regulations are required to have certain policies and controls in place. Under The Proceeds of Crime Act 2002 (POCA) and The Terrorism Act 2000, such firms are required to report money laundering suspicions via a Suspicious Activity Report (SAR). Where a company has concerns over potential or […]

Surprisingly, some firms are still not complying with the Money Laundering Regulations and the FCA’s oversight requirements for anti-money laundering compliance. For organisations such as Guaranty Trust Bank (UK) Limited, it appears that a past FCA fine totalling £525,000 in August 2013 for major AML systemic failings, was insufficient to make the bank review and revise […]