About the AML Self Assessment Checklist

![]() Use our AML Self Assessment Checklist to assess your compliance against the Money Laundering Regulations. Suitable for all industries and business types with a user friendly, customiable format. Analyse and identify your AML gaps with over 100 assessment questions relevant to the money laundering rules.

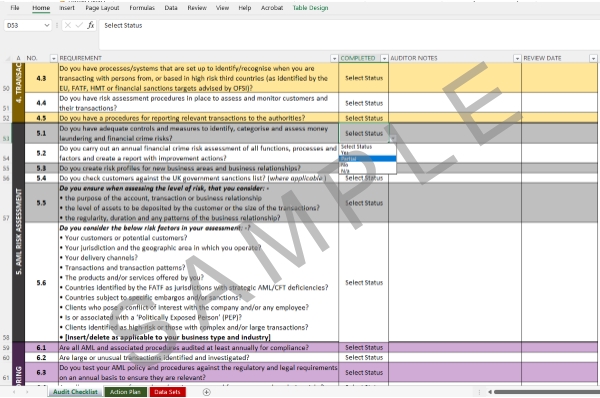

Use our AML Self Assessment Checklist to assess your compliance against the Money Laundering Regulations. Suitable for all industries and business types with a user friendly, customiable format. Analyse and identify your AML gaps with over 100 assessment questions relevant to the money laundering rules.

Quickly identify compliance gaps and any areas for improvement and use the integrated action plan to set priority status and review dates. The checklist tool is accompanied by detailed guidance notes for using and editing the document. This allows you to add to the existing questions and tailor the AML self assessment to your business and sector.

The checklist provides over 100 questions to assess the main AML business areas. However, it is not a complete money laundering audit. If you are unsure of how to comply with the requirements, you should contact your supervising body for guidance.

The AML checklist consists of 100+ assessment questions across 12 main money laundering and financial crime areas. The areas covered in the assessment are: –

- AML Oversight

- Policies & Processes

- Training & Competency

- Internal Controls

- Written Materials

- Due Diligence

- Risk Assessments

- Outsourcing & Suppliers

- Record Keeping

- Audits & Monitoring

- Transactions

- Tax Evasion

- Ready to Use Assessment – The checklist includes AML relevant questions to carry out a company-wide assessment of the main anti money laundering requirements. The assessment is ready to use, but is also fully customisable for simple business integration.

- MLR Compliant – With over 100 assessment questions, the AML checklist has been designed using the rules from the Money Laundering Regulations. It also covers specific requirements for the HMRC and FCA.

- Straightforward Audits – There are no difficult to use dashboards or complicated formulas with our checklists. What you see is what you get! Simple to use, straightforward questions that will help you to assess your compliance with the mandatory regulations and standards.

- Gap Analysis – Our self assessment checklists are invaluable for carrying out gap analysis on essential regulatory business areas. Answering the questions will provide information on which areas are compliant and which need improvements.

- Market Leading Checklists – Thousands of organisations already use our checklists to assess their ongoing compliance. Delivered in a Excel format, our self assessment checklists are flexible and user-friendly.

- Developed by Experts – The team at Know Your Compliance Limited have been writing regulatory policies and checklists for nearly 20 years. Our compliance expertise means that you can accelerate your compliance audits and still save time and money.

Our market leading AML Template Toolkit is used by hundreds of organisations to aid anti money laundering compliance. The toolkit includes 30+ policies, procedures, checklists and tools for AML compliance.

Our market leading AML Template Toolkit is used by hundreds of organisations to aid anti money laundering compliance. The toolkit includes 30+ policies, procedures, checklists and tools for AML compliance.