ANTI MONEY LAUNDERING

Anti Money Laundering products for any industry. Comply with the Money Laundering Regulations with our market leading range of policies and templates. Developed using the lastest regulations, including HMRC and FCA rules and guidance. Customisable AML policy templates, toolkits and checklists that save you time and money. Compare Our AML Toolkits.

£389.00 (ex vat)

£55.00 (ex vat)

£115.00 (ex vat)

£15.00 (ex vat)

£28.00 (ex vat)

£279.00 (ex vat)

£189.00 (ex vat)

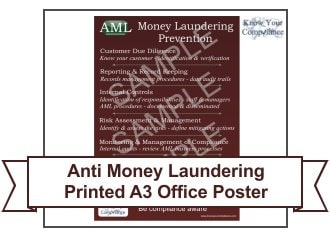

£12.00 (ex vat)

£20.00 (ex vat)

£25.00 (ex vat)

£15.00 (ex vat)

£58.00 (ex vat)

£29.00 (ex vat)

£20.00 (ex vat)

£85.00 (ex vat)

£15.00 (ex vat)

£15.00 (ex vat)