The Financial Conduct Authority (FCA) have just published their

2017/18 Business Plan, setting out their objectives, sector priorities, risk outlook, ongoing activities and the sectors who will come under closer scrutiny in the coming year. The plan also provides information on how the FCA will continue to meet their

3 main operational objectives: –

- Protecting Consumers

- Promoting Competition

- Enhancing Market Integrity

This article will give you a summary overview of the information and objectives laid out in the business plan and offer some guidance on the sectors that are still a cause for concern for the regulator. Due to the extensive content and information in the plan, not all priorites, objectives and sectors are covered here, so it is essential for regulated firms to take the time to read the

full plan.

Priorities

The FCA have detailed numerous priorities in their plan, including cross-sector priorities and those dedicated to specific sectors. Across all sectors, the regulator will continue to look at the culture and governance of firms and continue reviewing the regulatory framework that governs remuneration, with their existing Remuneration Codes seeking to ensure greater alignment between risk and individual reward and support positive behaviours and a strong and appropriate conduct culture within firms.

They aim to look into how new technology can improve the efficency of anti-money laundering (AML) processes and will again focus on the treatment of existing customers, with direct priorities for vulnerable customers, affordability assessment and addressing their needs.

Specific priorities include continuing to review the debt management sector, ensuring that they are fit for purpose and fully compliant, as well as starting an exploratory piece on the motor finance industry. Pensions and retirement plans will be reviewed, along with the pricing practices of general insurance and assessing how effectively competition is working in the wholesale insurance market.

Foreword and Introduction

The FCA Chairman, John Griffith-Jones, opens the plan with a foreword that speaks to the emerging risks that the regulator may need to respond to in the future and the challenges to the market outside of the FCA’s control. He mentions international events, demographic changes and of course Brexit and says

“while we cannot control them, we cannot afford to ignore them.”

The plan’s introduction is given by the Chief Executive Andrew Bailey, who references the simultaneous publication of the FCA’s

Sector Views and mission document and refers to the impact and consequences of the UK leaving the EU. He also discusses the business plans’ strong emphasis on consumer vulnerability and their forthcoming

‘Consumer Approach’ document and implementing the

Markets in Financial Instruments Directive II (MiFID II), which he says will

“allow [the FCA] to introduce major reforms to improve resilience and strengthen integrity and competition in wholesale markets.”

Risk Outlook

Part of the FCA’s role includes identifying and assessing emerging and future risks that may have an impact on their existing priorities and objectives, and to the financial system as a whole. This requires continuous focus and monitoring of the medium and long-term trends that may influence the financial sector.

With many of the long-term trends, the actual risks are still unclear and are likely to emerge and change with the progression of time, which means setting objectives and policies as and when accurate assessments can be made. In this business plan, the FCA have therefore focused on the short-medium term trends and emerging risks that can be assessed and predicted to a certain degree.

The regulator assesses emerging risks by using 4 key areas: –

- Macroeconomic – large-scale and/or general economic factors (e.g. inflation, unemployment or economic stability)

- Social and Environmental – changes to environment (e.g. land, energy use or natural resources) and social effects (e.g. workplace, community or demographics)

- Technological – how firms deliver products/services & how consumers acces them (e.g. advancements in technology, digital impact or systems)

- Firms and Consumers – the regulated businesses themselves along with the consumers using the financial services

Across these four areas, the FCA have identifed several trends and factors that could pose a risk to the financial market and/or influence the behaviour of those participating in the market.

Such risks include: –

- Continuing Low Interest Rates – pension funds, banks and insurance firms could find that lower investment incomes affect their overall profitability and as a result, take more risks in other areas to offset the fall.

- Rising Inflation & Low Income Growth – this could have a dual effect with some househods defaulting on debts due to the increased strain of rising inflation and a low income growth, which in turn puts pressures on lenders. Low income growth along with an increase in zero-hour contracts and variable incomes, could also see savings reduced and access to financial services limited.

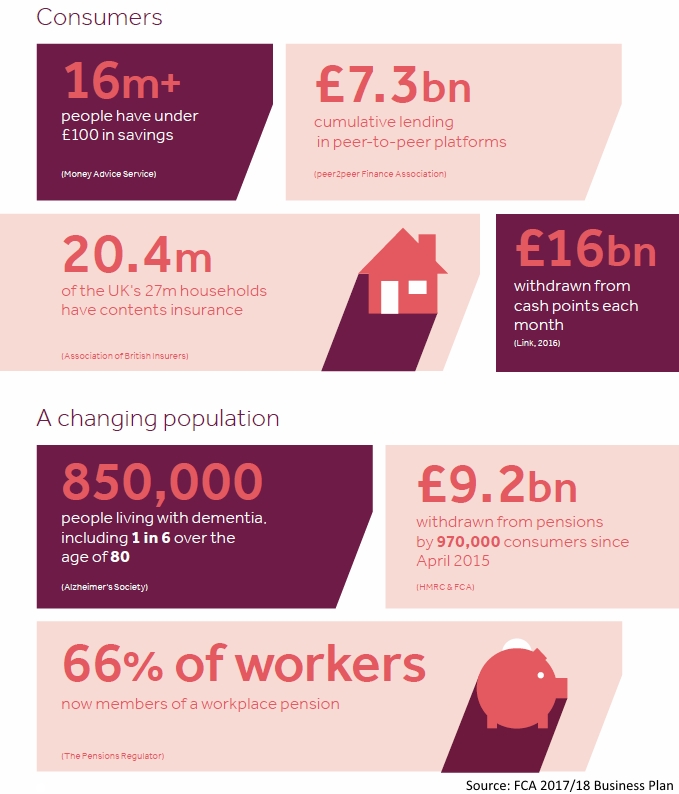

- Aging Population – it is projected that by 2040 nearly 1:7 people will be over 75, which poses risks for retirement income, pension products and an increasing number of vulnerable customers, with the elderly more prone to scams and needing more assistance when using financial products/services.

- Cyber Crime & Money Laundering – as technology advances, so do the risks of cyber-attacks and financial crime. Inadequate controls and systems could see information used inappropriately, consumers affected (directly or indirectly) and market integrity compromised.

- Outsourcing – as technology becomes a larger factor in the operation of businesses and with so many consumers relying on digital and mobile solutions, outsourcing to FinTech firms is increasing, along with the risk of reduced oversight and the resulting non-compliance.

- Known Consumer Behaviours – there is an increasing expectation on firms to identify and assess their needs, circumstances and sometimes behaviour of their customers, optimally resulting in suitable products and fair services. However, with growing numbers of vulnerable customers and financial pressures, firms must find the right balance between their responsibilities to consumers and making a profit.

Outcomes and Issues

A large part of the FCA 2017/18 business plan focuses on the cross sector and sector specific priorities, the issues within these areas and the activities and aims to address and resolve these issues. As this portion of the plan is extensive and applies to all firms in the majority of cases, it is important to read the plan and utilise the information relevant to your business type and activities. We have provided a brief overview of this area within the article.

Remuneration and incentive structures are still a key focal point for the FCA, who believe many of the schemes in place do not reward employee behaviours that act in the long-term interests of their customers. A lack of accountability from Senior Managers is another area that the FCA have been pushing for some time, with the the Senior Managers Regime (SMR) being implemented from 7th March 2016, which looks at the most senior employees within firms and makes them personally accountable for conduct and risk as well as having to undertake fitness and propriety checks.

Financial crime and money laundering feature heavily in the business plan, with the FCA looking for outcomes that will ensure appropriate safeguards, controls and procedures for preventing financial crime, whilst still allowing firms to operate efficiently and within the regulatory compliance system. Some of the issues faced by the regulator and market in this area include: –

- The possibility of weaker checks and due diligence measures on new clients in order to maximise profit and growth

- Firms facing higher costs from the implementation of digital tools to help reduce the risk of cyber-attacks and financial crime

- Consumers becoming more vulnerable and prone to scams, with emphasis on the pension sector

2016 saw the implementation of the FCA’s Annual Financial Crime Report, helping the regulator to assess the controls and measures put into place by regulated firms and to gain insight into the nature of the financial crime risks affecting the financial services industry. The FCA is also due to become responsible for reviewing the quality of AML supervision carried out by professional bodies in the UK. There are several bodies who are currently responsible for the oversight and compliance on the money laundering regulations and the FCA’s appointment as quality reviewer of these organisations will help to ensure consistency and quality.

With regards to the priorities for the treatment of existing customers, the FCA’s outcomes include: –

- More transparent and detailed renewal information in the relevant sectors

- Preventing and removing the barriers customers face when changing products/services or exiting existing products

- Firms expected to understand and consider their customers’ interests and needs and to actively engage with them to provide a good service

The issues in this area include current and future economic conditions and uncertainty with the UK leaving the EU, which could see firms focus more on growth and profit than consumer interests and larger numbers of consumer with debt having little or limited access to credit. Rising interest rates and low income growth could also put a strain on both firms and their customers.

The FCA intend to continue their strict review of the debt management sector, ensuring that the key controls and measures are in place to create a fair and transparent environment for their customers, with emphasis on those with vulnerabilities. They will also be focusing on the high-cost short-term credit sector as well as overdraft providers.

Ongoing Activities

The FCA will continue to help smaller firms to comply with the regulations through the delivery of their

‘Live & Local’ programme, which continues through 2017/18 and of course the ongoing supervisory role, for which the FCA define 3 specific aspects: –

- Pillar 1 – ongoing proactive supervision of the firms that present most risk to the FCA’s objectives

- Pillar 2 – event-driven, reactive supervision of actual or emerging risks

- Pillar 3 – thematic work that focuses on risks and issues affecting a number of firms across the market

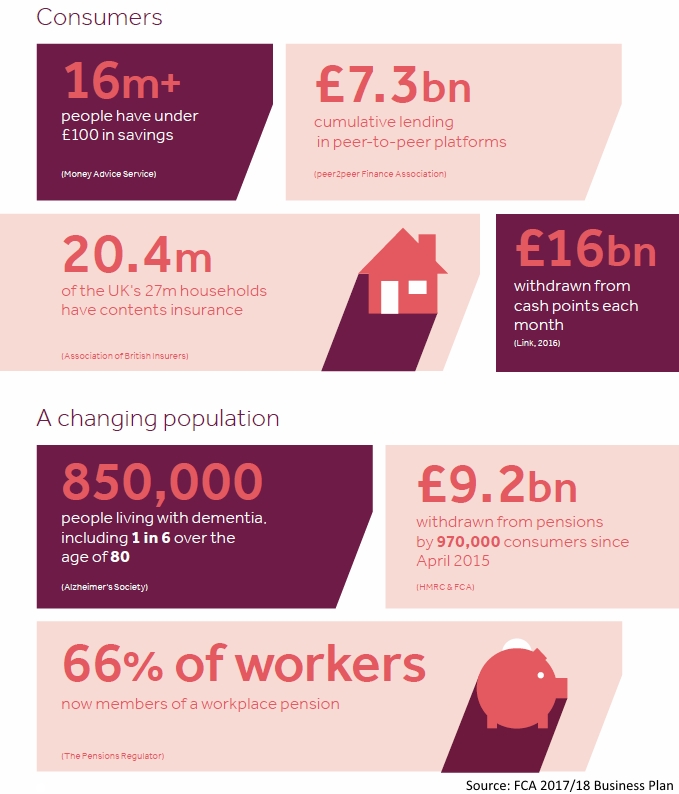

The FCA directly protect millions of UK consumers and help to make the market transparent and accessible, however part of their ongoing activities will also include the education of consumers about protecting themselves and ensuring that they are informed before making decisions and aware of fraud and scams.

Vulnerable customer awareness and assessing affordability are key areas that are ongoing for the FCA and are included in large sections of the business plan. With such detailed and focused work in this area, the regulator expects firms to have robust and adequate controls and measures in place for the identification, assessment and management of those considered vulnerable.

Summary

Whilst this article is quite extensive, it is only a brief overview of the 102 page document published by the FCA. It is essential that regulated firms and those associated with the financial services industry, take the time to read the plan and use the information provided to review and improve existing controls, measures and systems.

Click to read the full

FCA 2017/18 Business Plan.

The Financial Conduct Authority (FCA) have just published their 2017/18 Business Plan, setting out their objectives, sector priorities, risk outlook, ongoing activities and the sectors who will come under closer scrutiny in the coming year. The plan also provides information on how the FCA will continue to meet their 3 main operational objectives: –

The Financial Conduct Authority (FCA) have just published their 2017/18 Business Plan, setting out their objectives, sector priorities, risk outlook, ongoing activities and the sectors who will come under closer scrutiny in the coming year. The plan also provides information on how the FCA will continue to meet their 3 main operational objectives: –

The FCA have detailed numerous priorities in their plan, including cross-sector priorities and those dedicated to specific sectors. Across all sectors, the regulator will continue to look at the culture and governance of firms and continue reviewing the regulatory framework that governs remuneration, with their existing Remuneration Codes seeking to ensure greater alignment between risk and individual reward and support positive behaviours and a strong and appropriate conduct culture within firms.

They aim to look into how new technology can improve the efficency of anti-money laundering (AML) processes and will again focus on the treatment of existing customers, with direct priorities for vulnerable customers, affordability assessment and addressing their needs.

Specific priorities include continuing to review the debt management sector, ensuring that they are fit for purpose and fully compliant, as well as starting an exploratory piece on the motor finance industry. Pensions and retirement plans will be reviewed, along with the pricing practices of general insurance and assessing how effectively competition is working in the wholesale insurance market.

The FCA have detailed numerous priorities in their plan, including cross-sector priorities and those dedicated to specific sectors. Across all sectors, the regulator will continue to look at the culture and governance of firms and continue reviewing the regulatory framework that governs remuneration, with their existing Remuneration Codes seeking to ensure greater alignment between risk and individual reward and support positive behaviours and a strong and appropriate conduct culture within firms.

They aim to look into how new technology can improve the efficency of anti-money laundering (AML) processes and will again focus on the treatment of existing customers, with direct priorities for vulnerable customers, affordability assessment and addressing their needs.

Specific priorities include continuing to review the debt management sector, ensuring that they are fit for purpose and fully compliant, as well as starting an exploratory piece on the motor finance industry. Pensions and retirement plans will be reviewed, along with the pricing practices of general insurance and assessing how effectively competition is working in the wholesale insurance market.

With many of the long-term trends, the actual risks are still unclear and are likely to emerge and change with the progression of time, which means setting objectives and policies as and when accurate assessments can be made. In this business plan, the FCA have therefore focused on the short-medium term trends and emerging risks that can be assessed and predicted to a certain degree.

The regulator assesses emerging risks by using 4 key areas: –

With many of the long-term trends, the actual risks are still unclear and are likely to emerge and change with the progression of time, which means setting objectives and policies as and when accurate assessments can be made. In this business plan, the FCA have therefore focused on the short-medium term trends and emerging risks that can be assessed and predicted to a certain degree.

The regulator assesses emerging risks by using 4 key areas: –

Remuneration and incentive structures are still a key focal point for the FCA, who believe many of the schemes in place do not reward employee behaviours that act in the long-term interests of their customers. A lack of accountability from Senior Managers is another area that the FCA have been pushing for some time, with the the Senior Managers Regime (SMR) being implemented from 7th March 2016, which looks at the most senior employees within firms and makes them personally accountable for conduct and risk as well as having to undertake fitness and propriety checks.

Financial crime and money laundering feature heavily in the business plan, with the FCA looking for outcomes that will ensure appropriate safeguards, controls and procedures for preventing financial crime, whilst still allowing firms to operate efficiently and within the regulatory compliance system. Some of the issues faced by the regulator and market in this area include: –

Remuneration and incentive structures are still a key focal point for the FCA, who believe many of the schemes in place do not reward employee behaviours that act in the long-term interests of their customers. A lack of accountability from Senior Managers is another area that the FCA have been pushing for some time, with the the Senior Managers Regime (SMR) being implemented from 7th March 2016, which looks at the most senior employees within firms and makes them personally accountable for conduct and risk as well as having to undertake fitness and propriety checks.

Financial crime and money laundering feature heavily in the business plan, with the FCA looking for outcomes that will ensure appropriate safeguards, controls and procedures for preventing financial crime, whilst still allowing firms to operate efficiently and within the regulatory compliance system. Some of the issues faced by the regulator and market in this area include: –