What is Due Diligence? Why do you need to perform due diligence client risk assessments? Customer due diligence is the assessment, investigation and review of a supplier, business or individual with whom a company intends to form a business relationship. However, in addition to standard due diligence, part of the customer due diligence process is […]

What is Third Party Reliance? Using third party reliance templates enables you to meet your AML and due diligence obligations whilst complying with the mandatory regulations. Third party reliance does exactly what it says, it enables a relevant person to rely on a third party for carrying out certain due diligence measures. Part 4. Section […]

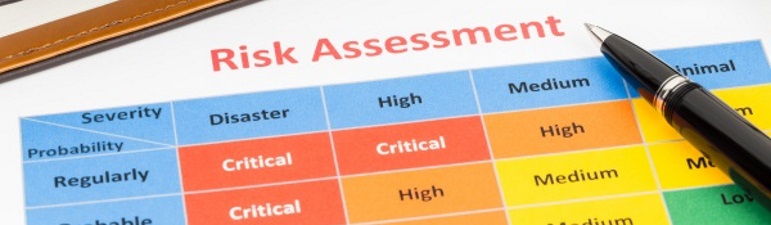

Whether it’s for standard due diligence or to comply with your anti-money laundering obligations, it is an essential business practice to risk assess new clients. It is during the onboarding of new clients that a company needs to learn as much as it can about the customer. This includes identifying and validating the reasons a […]

When you write a due dilience policy from scratch, it is important to understand your aims and obligations. Identify if you have any specific regulations or industry requirements for the Know Your Customer Controls. Businesses with obligations under the Money Laundering Regulations will want to write a due diligence policy that ties in with their […]

Nearly every business outsources some services or functions to a third party. Learn how to create an effective outsourcing policy in this article. Your suppliers and service providers need to be as compliant as you are! What is Outsourcing? The general definition of outsourcing is where a business choses an external provider to perform one […]

Compliance with the MLR and HMRC Those in the accountancy sector are required to comply with the Money Laundering Regulations (MLR) in the UK. This includes accountants, tax advisers, bookkeepers and insolvency practitioners. Having an effective and compliant Anti Money Laundering Policy template can save time and money. Anti money laundering is an extensive compliance […]

Businesses and sole traders with obligations under the Money Laundering Regulations (MLR) are required to be regulated by a supervisory authority. These include bodies such as the FCA, HMRC, The Gambling Commission and certain professional bodies. Businesses operating as an accountancy service provider are overseen by the HMRC and in additon to the MLR obligations, have specific requirements they must comply with.

Most firms will have an Outsourcing Policy Template that is used to document their objectives and procedures for outsourced services and functions. The term ‘outsourcing’ refers to any business function or service that is provided by, or contracted out to an external provider or supplier.

Common examples of functions that are outsourced or are provided by an external supplier include postal and mailing services; shredding and confidential waste disposal; IT services and disaster recovery; debt collection and translations.

The Government is currently seeking feedback on their intended amendments to the UK’s Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017. The consultation closes on 14th October 2021 with changes likely to be enforced from Spring 2022.