Due Diligence Client Risk Assessments

What is Due Diligence?

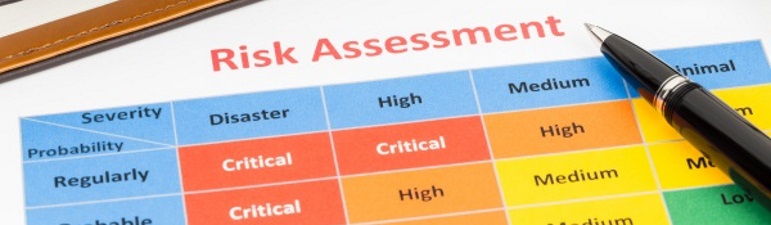

Why do you need to perform due diligence client risk assessments? Customer due diligence is the assessment, investigation and review of a supplier, business or individual with whom a company intends to form a business relationship. However, in addition to standard due diligence, part of the customer due diligence process is to undertake a client risk assessment. This assessment is mandatory for firms with obligations under the Money Laundering Regulations.

The purpose of effective due diligence is to protect both the company and the customer and mitigate any risks. Standard due diligence can also be accompanied by enhanced due diligence. This is where there are higher risks posed by the customer and/or their business activities.

AML Client Risk Assessments

A client risk assessment can be carried out by any business type to mitigate the risks associated with business relationships. However, it is a mandatory requirement for firms who must comply with the anti money laundering rules. Customer and enhanced due diligence include assessing the risks associated with the client.

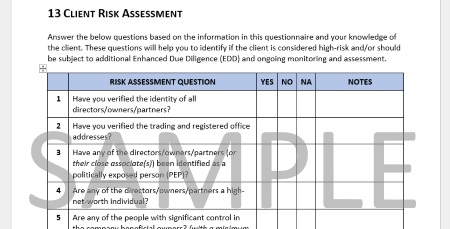

The format of the due diligence client risk assessment is to answer and document a series of questions about the client. Because the risk assessment is quesiton based, it is designed to gain an understanding of the client risk, position, nature, status and financial background.

Types of Client Risk Assessment Questions

There are numerous questions and criteria that a business would need to obtain from a client during the customer due diligence process. Some of these are dependant on the business type, industry and nature of relationship. Others are client dependant, such as relating to their status, geographical location or the type of transaction(s) involved.

Some of the common client risk assessment questions that an AML Supervisory Authority would expect to be documented include: –

- Have you verified the identity of all directors/owners/partners?

- Are any of the directors/owners/partners a high-net-worth individual?

- Are any of the people with significant control in the company beneficial owners (with a minimum 25% stake or voting right)?

- Have you obtained evidence to verify the source of funds and wealth for each director/owner/partner?

- Have you obtained a certificate of incorporation or partnership agreement?

- Do any directors/owners/partners have adverse credit or negative financial markers?

- Have you identified the clients’ key stakeholders?

- Has the PSC Register been checked to ensure the information provided matches that filed with Companies House?

Identifying a Clients’ Risk Level & Monitoring Frequency

Once a due diligence client risk assessment has been completed, you will have client markers to assess the risk of the relationship and any transactions. The question answers provide valuable management information.

Once a due diligence client risk assessment has been completed, you will have client markers to assess the risk of the relationship and any transactions. The question answers provide valuable management information.

However, they also enable the priority and frequency of any monitoring and follow-up audits to be set. Dependant on the risk level of the client, completing enhanced due dilience may also be required to meet anti money laundering obligations.

Use the Client Onboarding Questionnaires & Risk Assessment Tool from Know Your Compliance Limited and join over 8500 organisations already using our templates and toolkits.

Use the Client Onboarding Questionnaires & Risk Assessment Tool from Know Your Compliance Limited and join over 8500 organisations already using our templates and toolkits.

If you have obligations under the Money Laundering Regulations, it is mandatory to undertake customer due diligence. For instance, this should include a documented client risk assessment tool. Complete with customisable questionnaires and a user-friendly client risk assessment format in Word. Our professional, compliant template is only £25 (exc vat) and will save you time and money.

Benefit from simple document integration and demonstrate your due diligence compliance without starting from scratch. The benefits of our Client Onboarding & Risk Assessment Templates include:-

- Compliant, Customisable Templates

- Comprehensive Onboarding Questionaires

- Comply with Mandatory AML Requirements

- Simply Client Risk Assessment Framework

- Instant Download After Payment