What is a Vulnerable Customer?

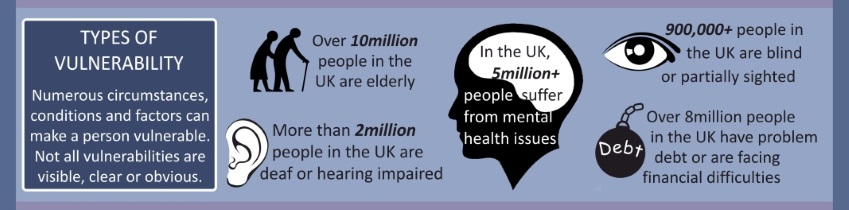

The Financial Conduct Authority (FCA) have always had a robust approach to the way vulnerable customers are managed by regulated firms. However, following on from reviews and the Covid-19 crisis, the FCA said “we want to drive improvements in the way firms treat vulnerable consumers and bring about a practical shift in firms’ actions and behaviour.” Getting those regulated by the FCA to understand ‘What is a Vulnerable Customer?’ is a major focus for the regulator.

In February 2021, the FG21/1 was published providing guidance for firms on the fair treatment of vulnerable customers. The 57 page document covers understanding the needs of vulnerable consumers; the skills and capabilities of staff; practical actions and monitoring and evaluation.

In July 2023, the Consumer Duty came into force for retail market clients. The outcomes and cross-cutting rules defined in the Duty focus heavily on good ourcomes and fair practices for vulnerable customers. Vulnerable Customer awareness goes hand in hand with treating customers fairly and ensuring adequate consumer protections. Assessing the nature and scale of characteristics of vulnerability that exist in specific sectors and business types is now mandatory for many products and services.

In July 2023, the Consumer Duty came into force for retail market clients. The outcomes and cross-cutting rules defined in the Duty focus heavily on good ourcomes and fair practices for vulnerable customers. Vulnerable Customer awareness goes hand in hand with treating customers fairly and ensuring adequate consumer protections. Assessing the nature and scale of characteristics of vulnerability that exist in specific sectors and business types is now mandatory for many products and services.

The Consumer Duty aligns with the guidance for firms on the fair treatment of vulnerable consumers and aims to improve outcomes for customers in vulnerable circumstances. All firms with retail market customers should be committed to ensuring that good outcomes are attainable for all customers, regardless of circumstance, situation or vulnerabilities.

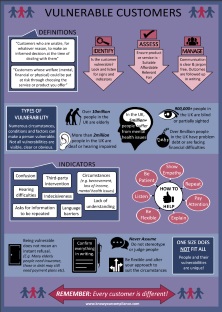

Vulnerable Customer Definitions

At Know Your Compliance Limited, we define a vulnerable customer in 2 main ways. Whilst defining what a vulnerability is has not specific format, these definitions are based on our own experience and that guidance set by the regulator.

- Customers who are unable, for whatever reason, to make an informed decision at the time of dealing with them – customers falling into this category include those with language barriers, hearing difficulties, those with mental health issues, suffering from bereavement, learning difficulties or the elderly. These customers may struggle to decide whether the service or product you are providing is in their best interests.

- Customers whose welfare (financial, mental or physical) could be put at risk through choosing the service or product you offer – these customers include anyone who is going to be put at detriment from taking up your offer/product/service. This includes financially (i.e. if taking out a loan or setting up a payment plan could cause them added financial stress).

The FCA defines a Vulnerable Customer as: –

The FCA defines a Vulnerable Customer as: –

“A vulnerable customer is someone who, due to their personal circumstances, is especially susceptible to harm, particularly when a firm is not acting with appropriate levels of care.”

FCA Approach to Vulnerable Customers

In their Approach to Consumers guidance paper, the FCA notes four factors that act as drivers to actual or potential vulnerability. These factors (and the examples provided) are non-exhaustive, but do offer context when assessing vulnerabilities.

- Health – examples can include physical disability, chronic illness, visual/audio impairments, mental health issues, impaired mental capacity.

- Life Events – examples can include caring responsibilities, bereavement, income/job reduction/loss, relationship issues, non-standard requirements (i.e. ex-offenders, refugees).

- Resilience – examples can include low/fluctuating income, debt, low/no savings, lack of support.

- Capability – examples can include low knowledge, understanding and/or confidence in managing financial matters, poor literacy/numeracy skills, language barriers, learning impairments.

In the FG21/1 paper, published in February 2021, the FCA stated that because anyone can find themselves in vulnerable circumstances at any time, the guidance and rules applies to most firms. These firms should be focusing on four main areas to achieve good outcomes for vulnerable customers: –

- Understanding the needs of their target market and/or customer base.

- Making sure staff have the right skills and capability to recognise and respond to the needs of vulnerable customers.

- Responding to customer needs throughout product design, flexible customer service provision and communications.

- Monitoring and assessing whether they are meeting and responding to the needs of customers with characteristics of vulnerability and make improvements where this is not happening.

Vulnerable Customer Policy Objectives

Each firm will have their own objectives and responsibilities when it comes to managing vulnerable customers. However, below are some generic objectives that can be included in your Vulnerable Customer Policy template.

- Ensure that all staff are provided with the training and tools to identify, understand, and deal with vulnerabilities and vulnerable customers.

- Email/telephone sales information and/or advice is followed up in writing containing the discussed content and any relevant terms and conditions and disclosure information.

- Ensure that staff on the front line are provided with additional vulnerable customer training and given appropriate lines of reporting should they need to escalate a matter.

- Ensure that ways to contact you are clearly visible on all communications and oyur website and provide a choice of ways to communicate with us, including: –

- Post

- Face to Face

- Telephone

- Online Chat

- Ensure that all written materials are clear, to the point and jargon free.

- Ensure that where applicable, the products/services that you offer are flexible and made to suit the customers’ needs and requirements.

- Offer flexible outcomes on products/services as dictated by the customers’ situation and circumstances.

- Deal with any authorised third-party in a helpful and transparent manner.

- Ensure that any sensitive and/or confidential information disclosed to you regarding the customers’ vulnerability is safe and secure and used, stored and destroyed in accordance with the UK GDPR.

- Implement the ability to flag/tag accounts where a vulnerable customer has been identified so that other staff can see immediately how the account is to be managed in the future.

This list is by no means exhaustive and will vary dependant on business type and sector.

Vulnerable Customer Policy Template

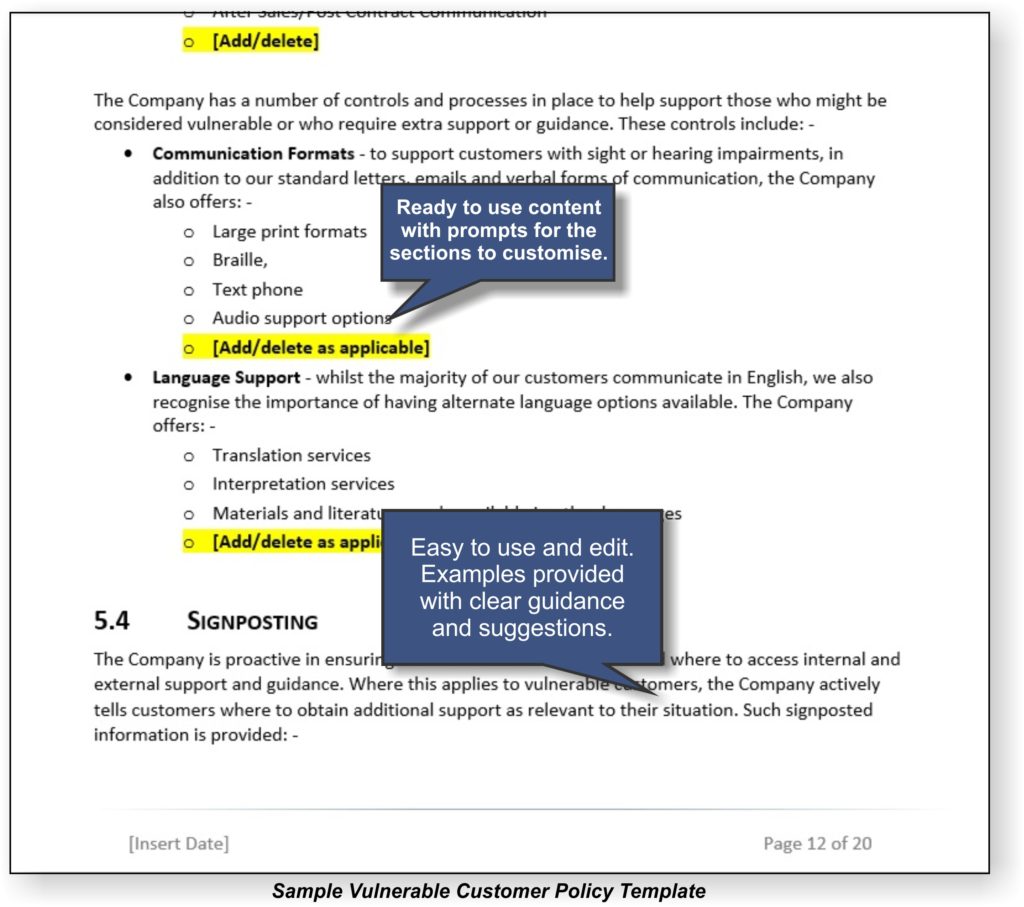

If you need to draft or revise your Vulnerable Customer Policy, our compliant, professional template provides 20+ pages of customisable content that aids compliance with the FCA’s expectations. Recently updated to include the Consumer Duty requirements, this industry leading vulnerable customers policy template is already used by thousands of organisations.

If you need to draft or revise your Vulnerable Customer Policy, our compliant, professional template provides 20+ pages of customisable content that aids compliance with the FCA’s expectations. Recently updated to include the Consumer Duty requirements, this industry leading vulnerable customers policy template is already used by thousands of organisations.

NOTE: This article was oroginally published in August 2021 but was updated in July 2023.