Our exclusive digital office posters are the best way to support your staff and guarantee their compliance. Our compliance poster sets are just £8 and come with ready to print PDFs and high resolution digital files. Support, remind and inform your staff about their compliance obligations with our visual posters and prompts. What are Digital […]

Why would you need to carry out a TCF self-assessment? If you are regulated by the Financial Conduct Authority (FCA) you will have obligations under the ‘Responsibilities to Customers‘ rules. Dependant on your business and permission type, you may also have similar obligations under the Consumer Duty rules. Treating Customers Fairly (TCF) remains one of […]

Having adequate, effective and compliant policies, procedures and training workshops on what makes a customer vulnerable, how to identify them and how to communicate effectively is not only a mandatory FCA requirement, but also an essential business practice. It is even more important in times of national crisis, such as the current pandemic, to ensure […]

The FCA adopted the TCF outcomes and standards from the FSA, with the aim of continuing to ensure fairness, clarity and transparency in the financial and credit sectors and affording consumers using finance products and services, due consideration and increased confidence.

TCF continues to remain central to the FCA’s priorities and business plan year on year, with organisations being expected to embed and embrace the TCF culture and 6 desired outcomes.

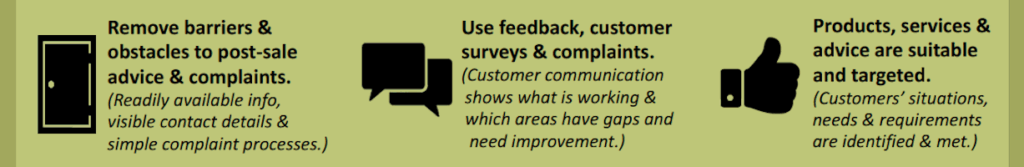

TCF Explained What is Treating Customers Fairly (TCF) is not a straightforward question to answer! Coined by the financial services industry, this ethos has far reaching implications for how compliant and effective a business is. Simply put, TCF is about ensuring that consumers get a fair and relevant product or service, and that the regulatory […]

On Tuesday, the FCA’s Executive Director of Supervision (Retail and Authorisations) Jonathan Davidson, delivered a speech at the Credit Festival, focusing on the challenges during the pandemic for consumer credit firms to take decisive and effective action when it comes to the fair treatment of customers. With the consumer credit industry including approx. 40,000 firms […]

Governing bodies have stressed how essential it is to have complete and robust compliance programs in place, with emphasis on data protection, information security, vulnerable customers and complaint handling. In these difficult times, people are extremely stressed and anxious, which may lead to additional complaints where service or product expectations have not been met. Whilst […]

During the Covid-19 crisis, it is more important than ever for regulated firms to consider their approach to treating customers fairly and vulnerable customers. The FCA have published a statement on their expectations for firms to maintain a high-level of compliance in both areas and for organisations to assess their existing controls and measures to […]

- 1

- 2