Vulnerable Customers and The Consumer Duty

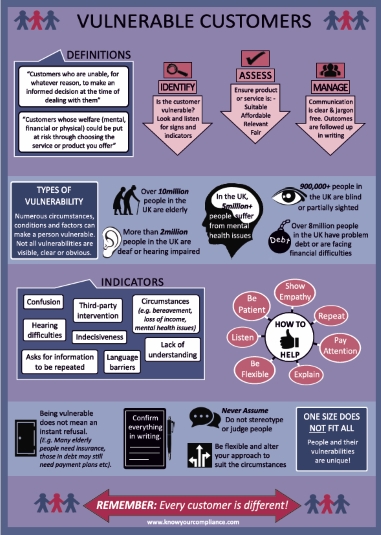

Who Are Vulnerable Customers?

The FCA define a Vulnerable Customer as: –

“Someone who, due to their personal circumstances, is especially susceptible to harm, particularly when a firm is not acting with appropriate levels of care.”

In their Approach to Consumers guidance paper, the FCA notes four factors that can act as drivers to actual or potential vulnerability. These factors (and the examples provided) are non-exhaustive, but provide firms with a good understanding and foundation on which to build. A robust and compliant approach to vulnerable customer awareness is key to complying with the FCA’s responsibilities to customers requirements. The four factors defined by the regulator are: –

In their Approach to Consumers guidance paper, the FCA notes four factors that can act as drivers to actual or potential vulnerability. These factors (and the examples provided) are non-exhaustive, but provide firms with a good understanding and foundation on which to build. A robust and compliant approach to vulnerable customer awareness is key to complying with the FCA’s responsibilities to customers requirements. The four factors defined by the regulator are: –

- Health – examples can include physical disability, chronic illness, visual/audio impairments, mental health issues, impaired mental capacity

- Life Events – examples can include caring responsibilities, bereavement, income/job reduction/loss, relationship issues, non-standard requirements (i.e. ex-offenders, refugees)

- Resilience – examples can include low/fluctuating income, debt, low/no savings, lack of support

- Capability – examples can include low knowledge/understanding/confidence in managing financial matters, poor literacy/numeracy skills, language barriers, learning impairments

What is The Consumer Duty?

The Consumer Duty (“the Duty”) aims to deliver a higher level of protection and security alongside clearer standards for retail customers. The Duty provides new rules and guidance on the fair treatment of retail customers as well as focusing on product governance and fair value assessments. A new Principle for Business and Conduct Rule have been added to the FCA Handbook to provide the overarching ethos of the Duty and the standard of behaviour expected of firms.

- Principle 12 – Consumer Duty – A firm must act to deliver good outcomes for retail customers.

- Conduct Rule 6 – You must act to deliver good outcomes for retail customers.

The Duty applies in relation to a firms’ retail market business or where the company communicates or approves financial promotions which are addressed to, or disseminated in such a way that they are likely to be received by, a retail customer. The Duty also comprises of cross-cutting rules, four outcomes and additional guidance. The rules and outcomes apply across the distribution chain, from product and service origination through to distribution and post-sale activities. The ‘distribution chain’ references all firms involved in the manufacture, provision, sale and ongoing administration and management of a product or service to the end retail customer.

The Cross-Cutting Rules

The cross-cutting rules summarise the standards of conduct that the FCA expect firms to meet to comply with Principle 12 and PRIN 2A. The rules define a firms’ actions and behaviours which will enable them to deliver good outcomes for customers.

The cross-cutting rules summarise the standards of conduct that the FCA expect firms to meet to comply with Principle 12 and PRIN 2A. The rules define a firms’ actions and behaviours which will enable them to deliver good outcomes for customers.

The cross-cutting rules require a firm to: –

- Act in good faith towards retail customers.

- Avoid causing foreseeable harm to retail customers.

- Enable and support retail customers to pursue their financial objectives.

The Four Consumer Outcomes

The new outcomes have been described by the FCA as “a suite of rules and guidance setting more detailed expectations for firm conduct in four areas that represent key elements of the firm-consumer relationship”.

The four outcomes are: –

- The governance of products and services.

- Price and value.

- Consumer understanding.

- Consumer support.

Vulnerable Customers and The Consumer Duty

Vulnerable Customer awareness goes hand in hand with treating customers fairly and ensuring adequate consumer protections. The Consumer Duty factors in customer outcomes and the expectation on firms to put the consumer at the heart of all business processes. Ensuring that products and services are suitable, fair and adequate for customers has even more implication when considering those with vulnerabilities.

Businesses should carry out assessments of the nature and scale of characteristics of vulnerability that exist within their sector and within the target market defined for each product and service. Understanding vulnerabilities and at risk groups will enable a company to put controls and processes into place to comply with the Duty and reduce customer harm.

Businesses should carry out assessments of the nature and scale of characteristics of vulnerability that exist within their sector and within the target market defined for each product and service. Understanding vulnerabilities and at risk groups will enable a company to put controls and processes into place to comply with the Duty and reduce customer harm.

Complying with the Consumer Duty requirements mean going above and beyond considering generic customer vulnerabilities that are person or situation specific and also reviewing and monitoring vulnerabilities and characteristics that apply because of specific business types and target markets. The Consumer Duty aligns with the guidance for firms on the fair treatment of vulnerable consumers and aims to improve outcomes for customers in vulnerable circumstances.

Consumer Duty Vulnerable Customer Policy & Procedures

Our standard Vulnerable Customer Policy is one of our best-selling products. This has now been updated to include the Consumer Duty references and enables a business to assess and consider vulnerabilities when working with customers. We also have tools for carrying out a Vulnerable Customer Audit Checklist and Vulnerable Customer Training Materials.

View All Vulnerable Customer Products...