Fraud Risk Assessment Example

This article written by Know Your Compliance Limited gives an overview of a fraud risk assessment example and provides guidance on the fraud risk assessment process. If you are looking for customisable fraud prevention policies, jump straight to our Anti Fraud Template Toolkit.

What is Fraud?

Fraud is any intentional deception that results in financial or personal gain. It is carried out with the aim of deceiving others and often involves the false representation of facts. Fraud can be committed within a business both internally and externally. It is therefore pivotal to successful fraud prevention to carry out a fraud risk assessment.

The Fraud Act 2006 (Act), which came into force on 15th January 2007. Under the Act 2006, a person found guilty of fraud is liable to imprisonment and/or to a fine. There are 3 definitions of fraud utilised in the Act: –

- Fraud by false representation.

- Fraud by failing to disclose information.

- Fraud by abuse of position.

![]()

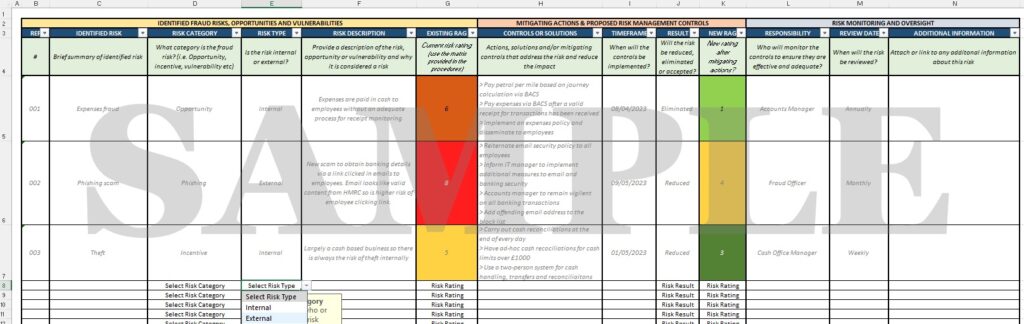

Fraud Risk Assessment Example

A business with obligations under the Money Laundering Regulations and Fraud Act 2006 should assess the risks associated with fraud. Once identifed, policies and controls can be implemented to prevent and manage those risks. A fraud risk assessment template should enable you to identify where the business is vulnerable to fraud. Adequate resources, funds, and systems can then be allocated to support the controls needed.

One of the easiest formats to develop a Fraud Risk Assessment in is Excel. This allows you to use pivot tables and conditional formatting to gain optimal management information from the assessment data.

When completing the fraud risk assessment, you should consider: –

- Client and employee due diligence

- Opportunities

- Vulnerabilities

- Any other third-party business relationships

- Risks identified through the AML risk assessment

- Conflicts of interest

- Our products and services

- IT systems and governance

- General accounting procedures

- Transactions and payment processes (i.e., cash handling)

Fraud Risk Assessment Process

Completing the fraud risk assessment in stages ensures that all aspects are covered, reviewed and documented.

- Stage 1. Identify the Risks – all processes, individuals, entities, channels and systems are assessed with a view to their vulnerability or opportunities to be a fraud risk. These risks are recorded on the fraud risk assessment template.

- Stage 2. Mitigation & Risk Management – identify controls, measures, systems, training and/or procedures that can reduce, eliminate or manage the identified risks. With suggested controls, reassessment of the risk rating is carried out as some risks will then have a lower risk rating.

- Stage 3. Development & Implementation – any controls, measures or systems identified in stage 2 that are not already in place are developed, sourced and/or implemented. Responsibility is assigned to a lead for each control project and an estimated completion date is defined to ensure that all projects remain on track.

- Stage 4. Authorisation – all stages of the risk assessment must be recorded using the provided templates and authorisation must be obtained.

- Stage 5. Monitoring & Review – procedures, controls and measures must be reviewed and reassessed annually to ensure they are still valid, effective and adequate. Risks to the Company should be reassessed and any new risks added to the risk assessment template.