Vulnerable Customer Checklist

Introduction

Vulnerabilities come in many different forms, including those created by permanent and temporary circumstances. Certain customers need additional support or guidance when purchasing financial products and services. Vulnerabilities vary by individual and group, meaning a vulnerable customer checklist is an essential tool for gap analysis and risk assessment. All FCA regulated firms are expected to have compliant processes and controls in place to support vulnerable customers.

What is a Vulnerable Customer?

The FCA defines a Vulnerable Customer as “someone who, due to their personal circumstances, is especially susceptible to harm, particularly when a firm is not acting with appropriate levels of care.” There are drivers and factors to actual or potential vulnerability. These include health, financial, life events and capability.

The FCA defines a Vulnerable Customer as “someone who, due to their personal circumstances, is especially susceptible to harm, particularly when a firm is not acting with appropriate levels of care.” There are drivers and factors to actual or potential vulnerability. These include health, financial, life events and capability.

When defining what makes a vulnerable customer, a broad statement can be used to. Customers who are unable, for whatever reason, to make an informed decision at the time of dealing with them and/or those whose welfare (financial, mental or physical) could be put at risk through choosing the service or product a firm offers.

FCA Guidance on Vulnerable Customers

In February 2021, the FCA published additional guidance for treating vulnerable customers fairly. Their FG21/1 paper, ‘Guidance for Firms on the Fair Treatment of Vulnerable Customers’, provides extensive information and advice for firms on how to identify, manage and monitor those customers requiring extra support.

The regulator states in the paper that protecting vulnerable customers is still one of their key focus areas. Through driving improvements in the way firms treat vulnerable consumers, the FCA wants to bring about a practical shift in the actions and behaviour of regulated firms.

Checklist for Assessing Vulnerable Customers

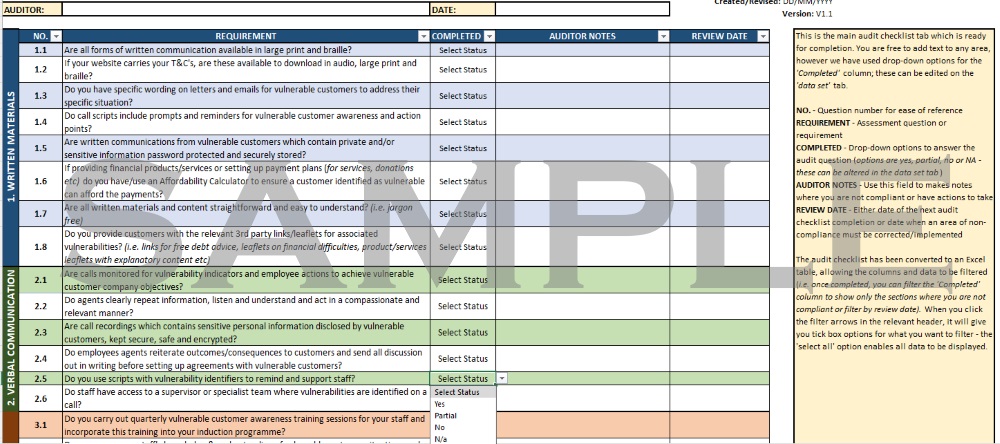

One of the best ways to ensure you are meeting your legal and regulatory obligations in any compliance area is to develop a vulnerable customer gap analysis checklist. Using assessment questions, you can complete a gap analysis of your approach to vulnerable customers and review your awareness and controls.

The vulnerable customer checklist questions should consider a firms written materials and website content; signposting; customer support channels and internal procedures and controls.

Good outcomes for vulnerable customers should be focused on four main areas: –

- Understanding the needs of a firms target market and/or customer base.

- Making sure staff have the right skills and capability to recognise and respond to the needs of vulnerable customers.

- Responding to customer needs throughout product design, flexible customer service provision and communications.

- Monitoring and assessing whether the firm is meeting and responding to the needs of customers with characteristics of vulnerability and make improvements where this is not happening.

Purchase Our Vulnerable Customer Checklist

Are you looking for a Vulnerable Customer Checklist to audit your FCA compliance and obligations? Our exclusive checklist can help you to assess if you are meeting the regulators standards and outcomes for vulnerable customer awareness. Understanding who vulnerable customers are and how you can manage them is an essential part of the FCA’s responsibilities to customers.

- Comply with FCA Standards

- Identify Vulnerable Customer Compliance Gaps

- Excel Based Assessment Tool

- 90+ Assessment Questions

- Instant Download After Payment

Know Your Compliance Limited have been providing regulatory compliance templates and checklists for over 10 years. With more than 10,000 organisations using our documents, you can be assured high quality, professional content and formats. Spend you time running your business and let us give you a strong foundation on which to build your compliance program.

View All Vulnerable Customer Templates!